In today’s dynamic financial landscape, earning money passively is no longer a fantasy—it’s a practical and achievable wealth-building strategy. Creating a monthly passive income stream through smart investments can provide financial freedom, reduce stress, and pave the way to early retirement. Whether you’re in the UAE or anywhere in the world, the key lies in making your money work smarter, not harder.

What Is a Monthly Passive Income Stream?

A monthly passive income stream refers to money earned regularly with minimal ongoing effort. It’s not tied to your time, unlike a job or business. Once set up, these income-generating assets continue to provide returns month after month, helping you meet your financial goals while allowing more freedom to focus on what matters most.

Why It Matters

Relying solely on a salary leaves your finances vulnerable to unexpected events—job loss, economic shifts, or health issues. A monthly passive income stream offers stability and flexibility, whether you’re looking to supplement your income, save for a major goal, or eventually replace your active income altogether.

Smart Investment Options to Build Passive Income

- Dividend-Paying Stocks

Investing in well-established companies that pay consistent dividends is one of the most popular ways to generate monthly or quarterly income. By selecting a diversified mix of global and UAE-listed dividend stocks, you can create a portfolio that yields stable payouts over time. - Real Estate Investments

Property remains a powerful passive income tool, especially in regions like the UAE, where rental demand is high. You can purchase rental properties directly or invest in REITs (Real Estate Investment Trusts), which offer regular income without the hassle of property management. - Bonds and Sukuks

Fixed-income securities such as government or corporate bonds and Islamic sukuks can offer predictable monthly returns. These instruments are less volatile than stocks and are ideal for conservative investors seeking stability. - Peer-to-Peer Lending and Digital Platforms

Technology has opened new doors for investors. Peer-to-peer lending platforms allow you to lend money in exchange for monthly interest payments. While risk levels vary, the returns can be higher than traditional savings accounts or fixed deposits. - Income Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) focused on income generation can be a smart choice for hands-off investors. These funds invest in a mix of dividend stocks, bonds, and other income-producing assets, providing a convenient way to diversify your passive income sources.

Tips for Creating a Sustainable Income Stream

- Start Early, Even Small: The sooner you begin investing, the more time your money has to grow.

- Diversify: Don’t rely on a single source—spread your investments to reduce risk.

- Reinvest Earnings: Reinvesting early returns can accelerate growth.

- Review Regularly: Monitor your portfolio and rebalance if needed to maintain consistent income.

Partner with Experts

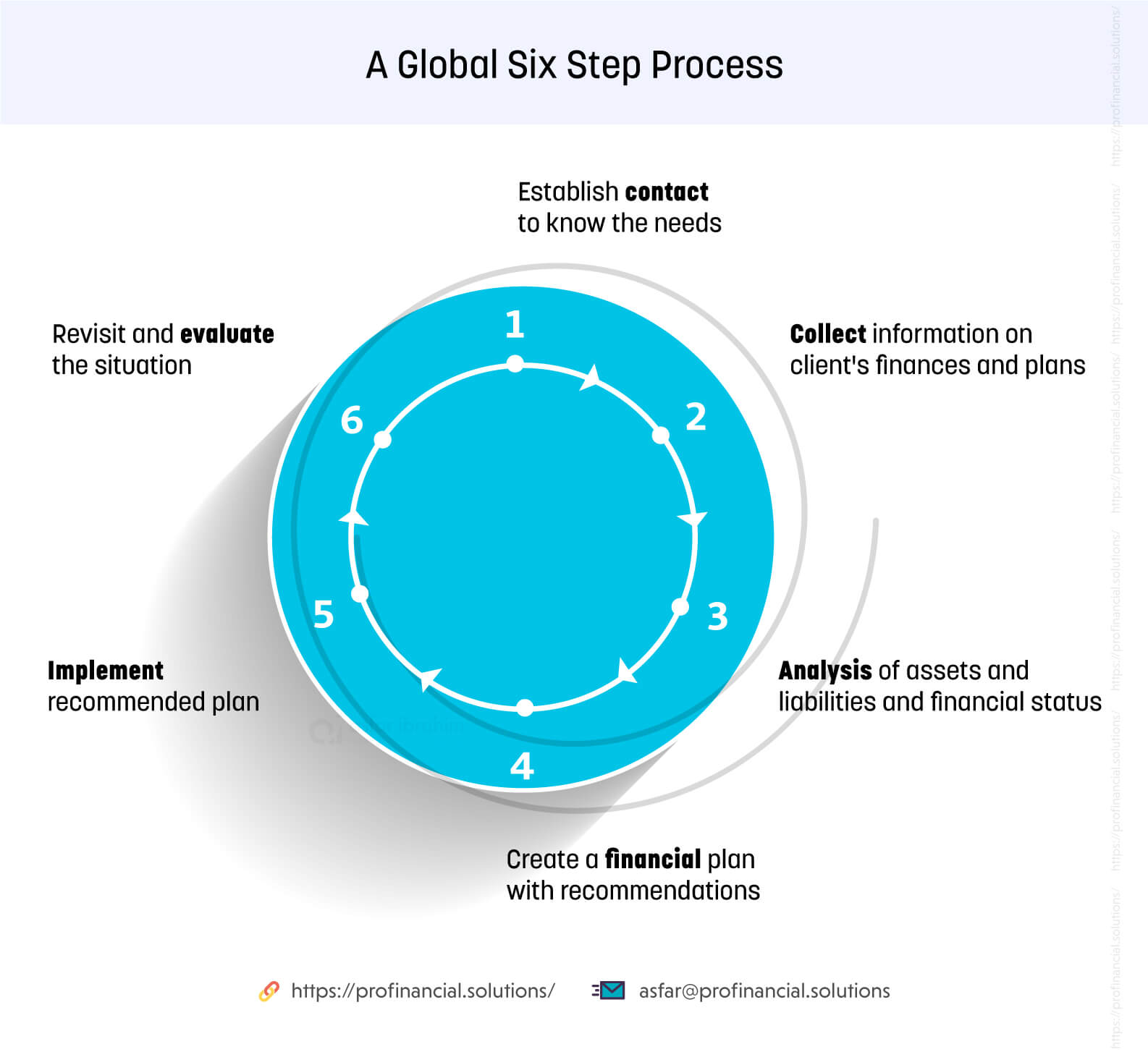

At Profinancial, we help you build a reliable monthly passive income stream tailored to your financial goals. Our expert advisors guide you in choosing the right mix of income-generating assets, ensuring you enjoy peace of mind and steady financial progress.

Want to turn your savings into a monthly income source? Contact Profinancial today and let us help you unlock your passive income potential.